Benefits

The University of Providence offers a comprehensive benefits package designed to support your health and well-being.

Medical Plan Options

- Two Medical plans to choose from

- Health Reimbursement (HRA) medical plan

- Health Savings (HSA) medical plan

- You have up to 30 days from your hire date or the date you become eligible for benefits to enroll. Will be covered from the day you were hired if enrolled within that time period.

Medical Plan Rates

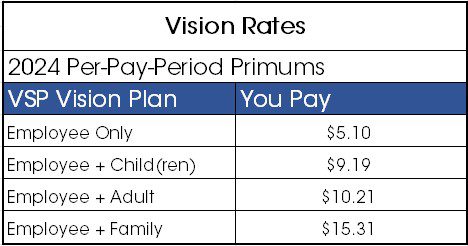

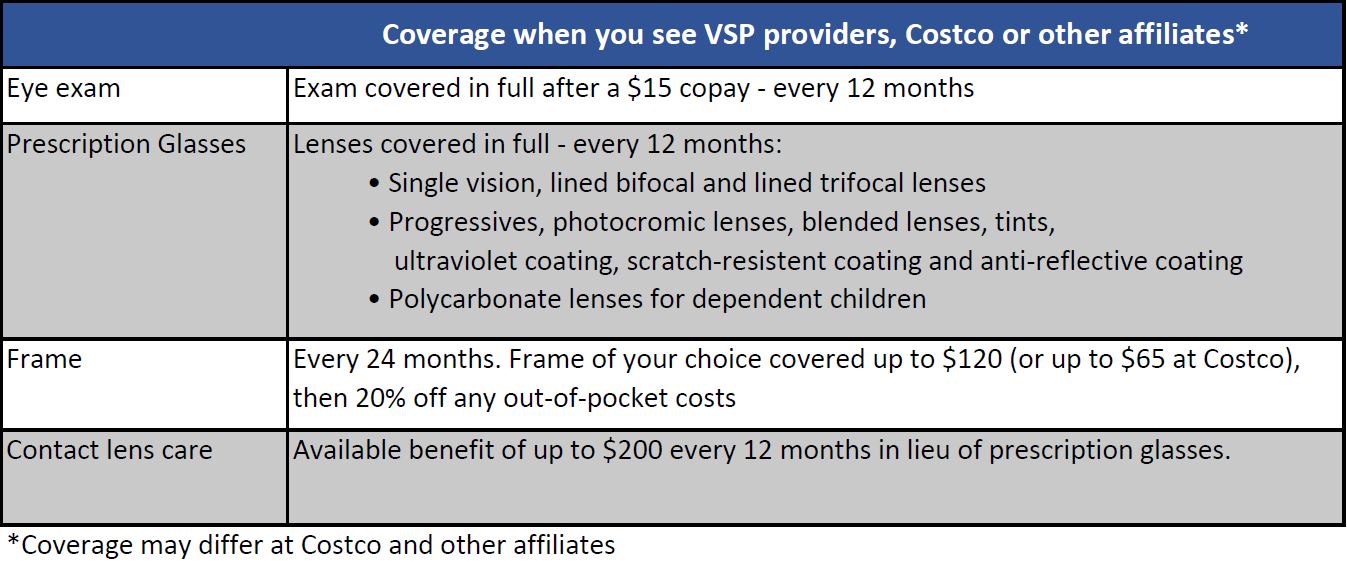

Vision Plan Details

Vision coverage provides benefits for an eye exam, as well as your choice of prescription glasses or contacts. The plan is administered by Vision Service Plan, or VSP.

Your vision plan pays a higher level of coverage when you use VSP network providers. The plan uses the VSP Choice network, which includes both optometrists and ophthalmologists.

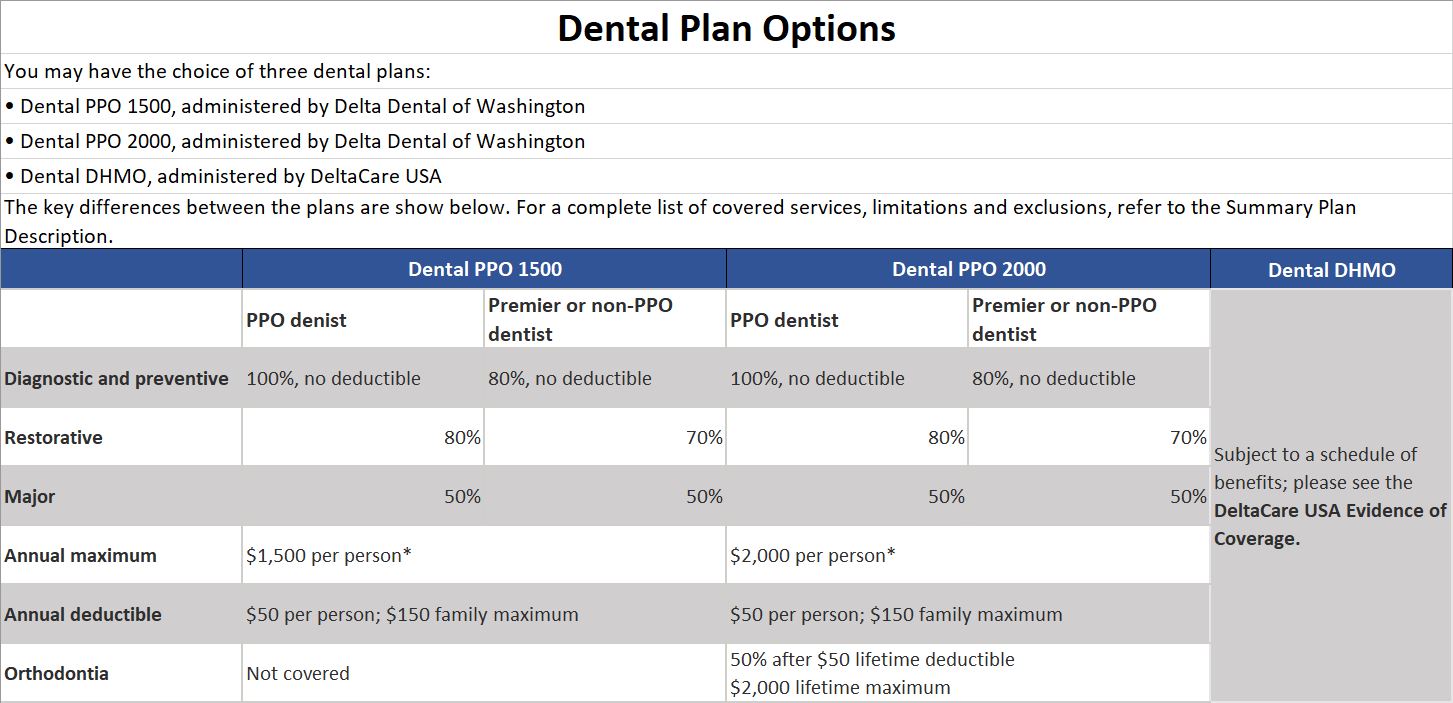

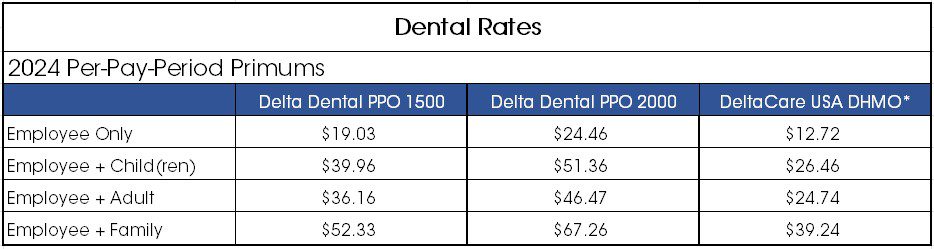

Dental Plans and Rates

Retirement Plan

The University of Providence participates in a 403b retirement plan through TIAA-CREF.

Key Plan Features

- The University will contribute 4% of benefits-eligible employee’s base salary toward the plan after one year of service.

- Benefits-eligible employees can contribute immediately with payroll deduction and can change their contribution at any time.

- Eligible employees are vested into the plan at the point of account opening.

- Employee must be age 25 or older to participate in the retirement plan

- Once enrolled, the 403b plan account can be managed online at TIAA.org

Additional Benefit Options

Covered by University of Providence (No Cost to Employee)

- Basic Life Insurance

- Caregiver Assistance Program (support across the mental and emotional health spectrum)

- Short and Long-Term Disability Insurance

- Well-being Resources

Employee Enrollment Options

- Health/Dependent Care Flex Spending Account

- Supplemental Life Insurance for employee, spouse, and dependents

- Long-Term Disability Buy-up Insurance

- Accident and Critical Illness Insurance

- Identity and Credit Protection

- Group legal Coverage

Time Away

The University of Providence offers time away for different needs. We encourage our employees to take the time they earn. We promote employee wellness and believe in taking time to recharge.

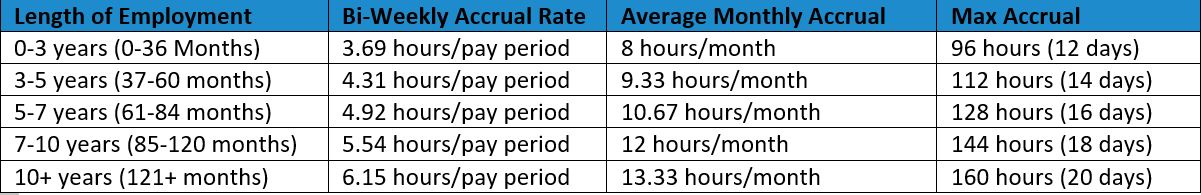

Vacation

The University grants paid vacation leave to benefit eligible staff employees (hereinafter “employees”). Employees earn vacation based upon the employee’s length of service and hours worked during the preceding month. For each month of paid 40-hour workweeks (prorated if paid less than 40- hour workweeks), employees earn vacation leave as follows:

Personal Holiday

The University will pay benefit-eligible staff employees for two personal holidays per fiscal year. An employee earns the personal holiday after the first workday of each fiscal year.

An employee may use a personal holiday for any reason but only on a day approved by the employee’s supervisor. An employee may not use a personal holiday during the introductory period of employment. The personal holiday must be taken in one-day increments.

Employees may not carry over the personal holiday from one fiscal year to the next fiscal year. The employee forfeits an unused personal holiday. Upon termination of employment, the University will pay the employee for a personal holiday earned but unused in that fiscal year.

Sick Leave

The University grants paid sick leave to benefit eligible employees (hereinafter “employees”).

- For each month of paid 40-hour workweeks (prorated if paid less than 40-hour workweeks), employees earn and accrue one day (8 hours) of sick leave.

- Employees whose first day of employment is after the 15th day of the month will not earn sick leave for that month.

- Earn 8 hours of leave for every month you work. Maximum accrual is 720 Hours (90 days) of sick leave. Sick leave can be taken as soon as it is accrued.

2024-2025 Paid Holidays (may vary from year to year)

| Independence Day | Thursday, July 4 and Friday, July 5, 2024 |

| Labor Day | Monday, September 2, 2024 |

| Thanksgiving | Wednesday, November 27, 2024 through Friday, November 29, 2024 |

| Christmas/New Years | Tuesday, December 24, 2024 through Wednesday, January 1, 2025 inclusive (returning Thursday, Jan 2, 2025) |

| MLK Jr. Day | Monday, January 20, 2025 |

| President’s Day | Monday, February 17, 2025 |

| Good Friday | Friday, April 18, 2025 |

| Easter Monday | Monday, April 21, 2025 |

| Memorial Day | Monday, May 26, 2025 |

Short Term Disability

- Employees on approved short-term disability will be paid 65 percent of their base pay in effect at the time the employee becomes disabled due to non-work-related illness or injury, including maternity

- Employees can supplement accrued leave to get up to 100% of pay during their approved leave

- Benefits are payable for a maximum of 26 weeks or 180 days

- There is a 7-day waiting period for benefits to take effect

Long Term Disability

- The employer-paid benefit pays 60 percent of the employee’s base pay, subject to taxes, after 180 days of disability as long as the employee remains disabled

- Employees can supplement LTD benefit with accrued leave to get up to 100% of pay during their approved leave

- If you remain disabled, your LTD benefits will generally continue until your normal Social Security retirement age.

Tuition Benefits

Tuition and Fee Remission Policy

Full‐time benefits-eligible employees are eligible for tuition and fee remission the first semester after the employee has completed the introductory period of employment

- Part-Time benefits-eligible employees are eligible for tuition and fee remission the first semester following two consecutive years of employment

- An employee’s spouse, as well as children of the employee under twenty-five years of age who are legal dependents of the employee are eligible for undergraduate tuition remission, whenever the employee is eligible

- Undergraduate tuition remission is generally tax-free.

- Graduate tuition will be charged at the Providence Health Rate and remission will be limited to the tax-exempt excluded amount allowable by Section 127 of the Internal Revenue Code

Limitations on tuition remission usage may apply. Please contact Human Resources at (406) 791-5977 for more information.

Tuition Exchange Agreements

At times, the University has tuition remission exchange agreements with other schools. Tuition exchange programs provide the opportunity for eligible employees and their dependents to receive scholarships at one of the participating member institutions. Employees may apply, on behalf of themselves or their qualifying dependents, for scholarships through two organizations: The Tuition Exchange and the Council for Independent Colleges.

A list of participating colleges and universities can be found at the websites below:

The University of Providence is a Catholic, student-centered, mission-focused university. For more information, please contact Human Resources at 406.791.5976.